Protecting your family from unexpected future financial costs, is one reason why many Australians have begun working with their financial planner or local funeral service provider to safeguard and protect their families.

While many of us would not even contemplate the conversation, let alone the thought of planning for the passing of someone, with an increase in the incidence of mortality because of COVID-19, as a community we are more aware of death and its impact on a family and the community as a whole.

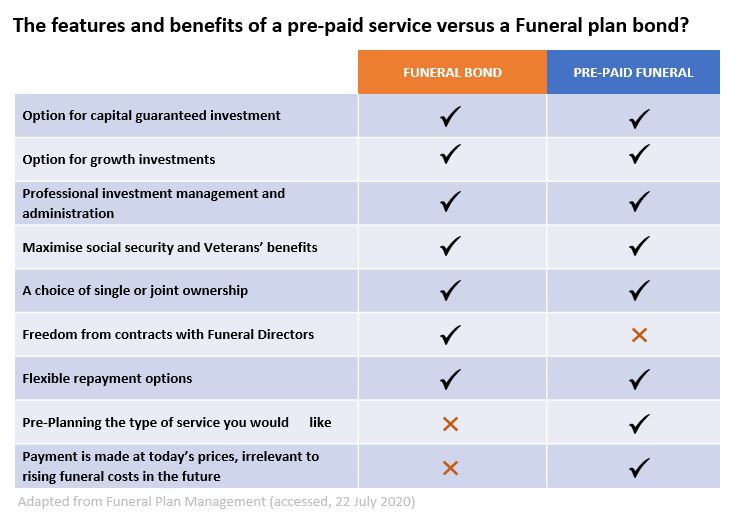

This then warrants the conversation, of why pre-plan or pre-pay for future funerals and what steps and safeguards have been put in place to protect your investment? In this article we will go through each of the options and the safeguard measures in place.

Why Pre-pay or pre-plan for a funeral?

There are several advantages of pre-paying for funerals. The financial and increased costs of funerals have been reported by the Australian Senior Cost of Death report (2019). They reference funeral costs in 2019, having doubled since 2011. By pre-paying or pre-planning a funeral, individuals and families can financially benefit by selecting a funeral package and price at today’s rate. This means that regardless of whether costs and rates double in the future, the cost of the funeral remains fixed for the individual. Savings are one way of benefiting from pre-planning and pre-paying. A second benefit for pre-planning or pre-paying, is the flexibility in reviewing a number of funeral directors and then selecting a funeral director that you would like to engage in that you feel comfortable will do a great job in the future. For families, it will mean that rush decisions are not being made due to time-constraints and pressures, usually experienced at the passing of a loved one.

A final benefit relates to having special requests or wanting to have a great celebration of your life. Special requests may well be added into your will but given the time-pressures when moments like this descend upon families, wills are usually the last thing people will be looking at initially. Having a pre-planned funeral, means that you can control all the planning and arrangements for the funeral. From selecting a specific burial site, through to the location of the service, whether it will be a cremation versus a traditional burial, the type of flowers, music or perhaps you would like to donate your organs and want to ensure that the funeral director, has all the details and instructions to execute this seamlessly. Ultimately, you retain full control of your wishes and the intention of the pre-planned funeral is that your funeral director will respect your wishes and execute them to the final letter of your plan.

What is a funeral bond? How does it work?

The option to choose your investment level. A FuneralPlan® bond, has the specific objection of covering your funeral expenses. Through this ability, you have the option to choose a “capital guarantee option”, which means that your contributions and allocated bonuses are always secure. Or you can choose the “conservative or moderate investment”, which means that if in the future you want to increase the value of your policy, you can do so through a combination of income and capital growth.

A funeral bond is easy and flexible because it means that you can open an account with a lump sum of $500 and top this up at any time, with a minimum of $50. You have the choice of stopping any instalments at any time, without a penalty if your circumstances change. Annual bonuses are also exempt of any personal income tax.

Tax benefits: Your FuneralPlan® bond will not affect your means tested pension, so you can invest up to the current government threshold of $13,250 for 2019/20 financial year. There is no limit to your investment if the means test is not applicable to your personal circumstances.

Quick to claim: If you are the executor or next of kin, you can quickly and easily claim the funds within your FuneralPlan® Bond, by providing the required documentation. The funds will be paid to you within two working days.

How is a pre-plan safeguarded?

To protect your savings and investment, each state government has several rules that must be adhered to. A key one is, that funeral directors, must register and contribute your money into an independent registered funeral fund that adheres to the relevant state and government legislation.

Victoria Cross Funerals has partnered with the independent provider Funeral Plan Management to give you peace of mind.

What are the next steps?

Victoria Cross Funerals is an independent, family owned and operated funeral service business, based in Sydney. We are proud to offer services to all faiths and embrace people of all denominations, cultures, traditions, backgrounds and beliefs. Get in touch with us today to discuss whether pre-planning, pre-paid or funeral bonds is the right option for you. We will make sure that you experience our caring and personalised service beyond the standard industry expectations.

Contact the team today at info@victoriacrossfunerals.com.au to request more information or to download the Funeral Plan Profile booklet to begin your planning.

You can contact us on phone number or send us a message through form below

02 9188 7708